Think The FX Market Is To Large To Be Manipulated? Market Rigging 101

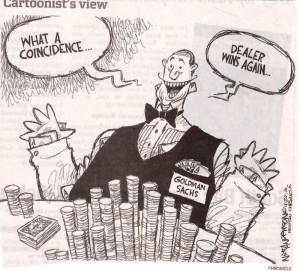

I can’t tell you how many times I’ve been told the “forex market is too large to be manipulated”. Time and time again people fail to realize that the size of the market means nothing. What matters is how condensed that volume it. The fact remains that 80% of the daily volume goes through just 10 institutions. Therefore size is not really the point. Regardless of the market size, if only 10 institutions control 80% of any market they WILL have the ability to move price. Do the banks control every market move? NO! What most people don’t realize is the banks simply make the market. They are the “market makers” of the Fx market. With that being said their main function is to fill orders by either taking the other side of the position or filling it in the market. Their majority of their profits come from commissions, NOT speculative trading. Their main function is to find liquidity for their clients which is why manipulation has always, does, and will always exist. That is always why our bank trading strategy continues to preform very well in even the roughest market conditions. Here is a great article on zerohedge titled, Meet The (First) Seven Banks Who Rigged The FX Market. When you see how much they are playing in legal defense just imagine how much money they must be making.

-Sterling