Something Different Part 2 – EURAUD March 23, 2014

Welcome to part of the EURAUD March 23, 2014 trade setup! In the previous post we looked at the H1 chart and some observations we noted regarding the trade setup. If you have not read Part 1 of the article please do so before continuing: Something Different – EURAUD March 23, 2014

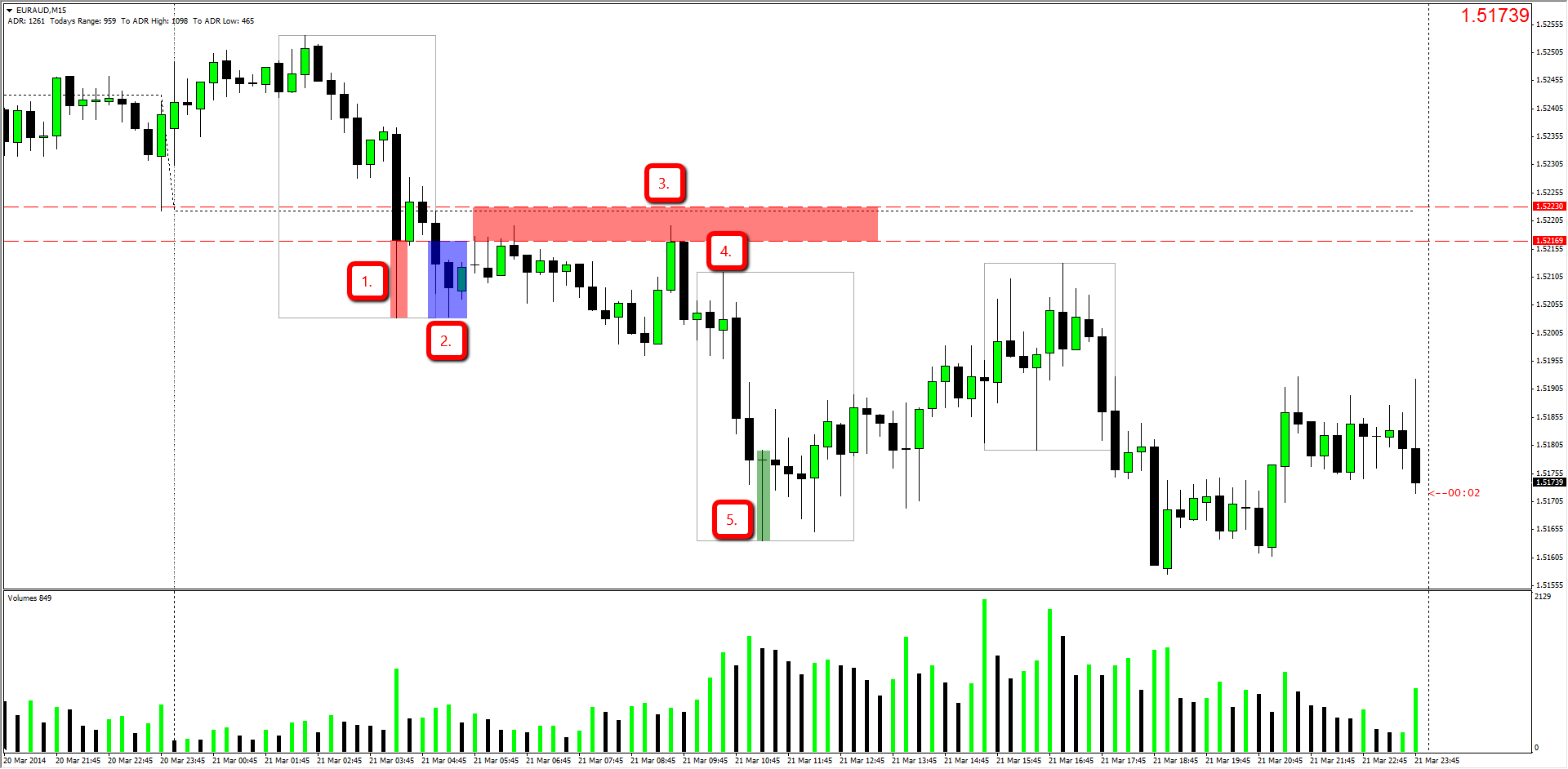

M15 Time Frame – Looking At Things From An Entry Point Of View!

Notes On M15 Time Frame:

- Previous Rejected Area/Taking Out Demand

- Second Test Into Rejected Demand Area/Taking Out More Demand

- Level Of Interest/Significance

- Entry Candle Regarding Risk:Reward

- Exit Candle/Stop Run Against The Trade

The above mentioned is just a few things of importance on the M15 EURAUD chart above, and arguably the 5 most important factors making this a successful trade.

What do I mean by successful?

- Low Risk High Reward Opportunity

- Protecting Capital By Knowing When To Exit

This is what we here at Day Trading Forex Live call a backside trade off of the level. This occurs when price breaks through a ‘level of importance’ and then provides us with a trading opportunity at the re-test of that same level. This makes it a backside/opposite side of the level type trade. To put it plain and simple one can see it as support breaking, becoming resistance and then presenting a trading opportunity on the resistance side of the level. Classic support becoming resistance type scenario. REMEMBER that this means absolutely nothing without the weekly pushes and candle setup at our marked level of interest, where we expect Smart Money to manipulate price.

The Trade Entry Explained

After the first few tests of the level, which is now resistance, we moved in a downwards direction breaking the day’s low by a few pips. Soon after that we saw 2 strong bullish candles run back up into our level at 1.5216, rejecting it and closing below. This followed with a perfect bearish candle closing below the body of the previous bullish candle, giving us a nice ‘set of legs’. All we were left to do was to wait for the pullback, allowing us a safe stop above the previous day’s lows. 45 Minutes later the waiting paid off, giving has an entry on the third candle(4.). Taking your entry on a 50% retrace of the confirmation candle would have allowed for a stop loss well above the previous day’s lows and the 1.5223 level.

Step one is now complete. We entered the trade, giving it enough room to play out with a more than big enough stop. Step two is now in progress – setting your stop loss for a 2:1 RR. In this case a 20 pip stop loss would have been the most likely used. Step 3 is to sit back and let one of two things happen!

1. Price Comes Back Up And Hits Your Stop Loss.

2. Price Continues Down And Hits Your 2:1 Take Profit.

More or less the same amount of time it took you to wait for the entry, it took to hit your Take Profit(5.) for a nice 2:1 Risk Reward! If you had a bigger Take Profit set in place the pin bar(5.) should have been your signals to jump out and exit the trade, move to break even or move to + 20 pips.

I really hope this Two Part Article helped and gave some insight on how we look at trades and how you can as well!

Happy Trading!