How Successful Traders Think – The Secret To Breaking Mental Barriers

You, like most who will read this article, have probably been trading forex for months or even years. Over that time you have no doubt gather together a great deal of information. Some of the information you value and some you no doubt have tossed to the side. If you had to pick the single most important key to success that you have learned what would it be? A good majority would point to their forex trading strategy as the key to success. Over the past 5 years of teaching, however, I have found one single factor that is more critical to success than all others….trading psychology. This article series will break down how your current psychological patterns keep you from making money, and more importantly how you can immediately develop a successful traders mindset.

Perception Of Success

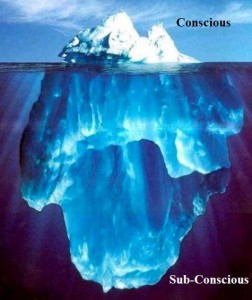

In normal life, the subconscious mind serves a very important role. Everything you see, hear, taste, touch, smell, or experience is information the mind collects.  Consciously we never realize all the information the supercomputer between our ears stores as we cannot process the information consciously. The subconscious brain, however, does not have to process information as it mainly acts as a storehouse of information for later use. Unfortunately for most, ingrained thought patterns are also stored. This last point works to the major disadvantage of traders. How so?

Consciously we never realize all the information the supercomputer between our ears stores as we cannot process the information consciously. The subconscious brain, however, does not have to process information as it mainly acts as a storehouse of information for later use. Unfortunately for most, ingrained thought patterns are also stored. This last point works to the major disadvantage of traders. How so?

It starts with what I term as your perception of success? What is your perception of success in the forex market? Another words when you envision success in trading do you envision winning 70% of your trades….80%? Or when you envision successful trading is the first thing that comes to your mind risk/reward ratios. This requires you to be honest with yourself. When most envision successful trading they automatically focus on win/loss ratios. Here is a simple experiment to prove the point. Go to google and type in “forex trading course” or “learn to trade forex.” Then click on some of the paid advertising. As you scroll through those one page/get rich quick sales letters what are they pitching? More often than not they will try to sell the strategy by pitching win/loss ratios. Risk/reward doesn’t sell and thus win/loss ratios are the focus.

Remember that subconscious tape recorded between your ears we talked about? From the beginning of your time in the forex market, you have been bombarded and dare I say programmed to believe success in the forex market comes from high win/loss ratios. This is what molds your perception of success. Here is where that belief gets dangerous.

The “Subconscious” Problem

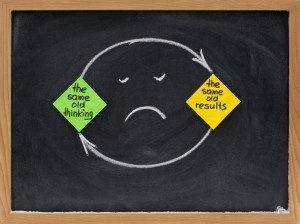

It’s no secret that at least 95% of traders are losing money or break even at best. For most traders, this goes on for months and then those months turn into years. Month after month of not hitting your “perception of success” is recorded by the subconscious. After years of failure, the subconscious is filled with negative thought patterns as a result of negative trading experiences. Traders wonder why they always have a nagging negative feeling of doubt after a week of success. Its because that one week of success is trumped by your brains memory of months or years of failure. Simply put the subconscious mind has recorded month after month or year after year of failure, and thus this shapes your thought pattern moving forward. In my opinion, this one point causes more people to unknowingly sabotage their trading more than anything else! So how can this be avoided? After all, you can’t erase months or years of failure from your subconscious memory?

Remember when I mentioned your perception of success? Your mind has an idea of what it calls “successful trading,” and for most this is a good win/loss ratio. The fastest way to change your success is to change what your perception of success is. At this point, your subconscious mind will continually sabotage your trading if you keep shooting for the same goal that your subconscious memory knows you have never achieved. By changing what you define as “success”, you can essentially ‘trick’ your mind into a positive state which is more likely to produce desirable results. How can this be done?

Changing Core Beliefs

If you are not experiencing the level of success you would like in the forex market then I highly recommend giving what I’m about to talk about some serious consideration. Again,  after months of years of never hitting your vision of success, the subconscious is trained to believe success in the forex market is not possible. Rather than trying to spend months retraining the mind, it is much easier to change what you call success.

after months of years of never hitting your vision of success, the subconscious is trained to believe success in the forex market is not possible. Rather than trying to spend months retraining the mind, it is much easier to change what you call success.

Here is your new goal in trading. Win/loss ratio of 50% and a R/R ratio of 2/1. Simply put I want you to have a goal of winning 50% of the time. Why? Well….do you believe that you can win 50% of the time? I’m sure most of you immediately say yes as you believe this is an achievable goal you can hit. Instantly we have just changed your core belief! The second step to this actually working is understanding just how profitable the above goal is. For that let’s do some math.

1 trade per day X 22 trading days in an average month = 22 trades per month

At 50/50 win/loss, 11 trades will lose you 2% each, and 11 trades will make you 4% each (Reward/Risk is 2/1) =Total Monthly Profit Of 22%

Now let’s see how 22% a month compounds over the course of a year on a $5,000 account.

JAN FEB MAR APR MAY JUN

$6,100 $7,442 $9,079 $11,076 $13,513 $16,486

JUL AUG SEPT OCT NOV DEC

$20,113 $24,538 $29,937 $36,523 $44,558 $54,361

We’ve now done two things. First and most important, you have a goal that you instantly believe you can achieve. This is the essential key to tricking the subconscious into believing success in the forex market is possible. The second step is understanding just how profitable a 50% win/loss ratio in combination with a 2/1 R/R can be. Now that you have a goal the key is implementing that plan.

Implementing The Plan

I think it goes without saying that you simply cannot randomly start putting on trades with a 2/1 Reward/Risk ratio and hope for the best. The key is having a trading strategy and entry technique that is designed to identify high R/R trade setups. Tracking manipulation does just that. Without a doubt, we do not win every trade. The true power of our bank trading system does not come from the win/loss percentage; rather it comes from the potential reward as compared to the risk these trades produce. Manipulation often marks short-term turning points for intra-day trends. It not only tends to start these moves but it is also seen near the end quite frequently. As such, when we have correctly identified a smart money entry point it more often than not very near to the start of an intra-day turning point. This allows for the greatest potential reward/risk ratios and thus why tracking bank manipulation lends itself to high R/R trade plans. If your interested in putting these tips into practice I highly recommend only using a trading strategy designed to search out high reward/risk trade setups.

-Sterling

Special Offer: This Month Get Our Advanced Bank Trading Forex Course, Daily Market Reviews, Live Forex Training Room, Members Forum, And Lifetime Support At A Special Discount – Click Here

DID YOU ENJOY THIS FOREX TRAINING ARTICLE? IF SO PLEASE +1, LIKE, OR TWEET IT OUT!

Check Out These Other Training Article & Videos

- Reactive Vs. Predictive Forex Trading – How Banks Manipulate Markets

- How Banks Manipulate Traders Around Economic Data

- Complete Day Trading Entry Strategy