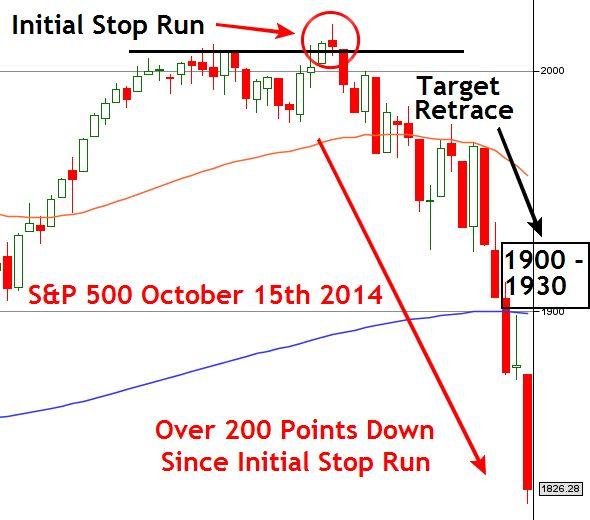

How I’m Trading The Equity Market Crash – October 15th 2014

If you didn’t see the blog post from the September 22nd 2014 that pointed out the S&P 500 daily stop run reversal trade setup then I would highly recommend checking that out to see why I was calling a potential market top nearly a month ago. Unless you have been living under a rock (which might not be a bad idea right now #ebola) you have been watching the equity market get hammered especially over the last 5 days. This blog post is not about pointing out how awesome my market top call was (patting myself on the back) but more about what I’m looking for now. History, in the equity market especially, tends to repeat itself time and time again. Therefore we gain quite a bit of information by looking back at past market turns. Crashes like 1929, 1987, 2001, 2007-08 give us great info we can use now. First, don’t panic! Don’t be the guy who sells right at the bottom only to see the market come back. If you take nothing away from this except for one point let it be this…all the previously mentioned market crashes start very aggressively but then ALWAYS make at least a 50% retracement of the first drop. This retracement is when you hear CNN, MSNBC, and the like talking about how things are looking up and all is good from here…all will not be good from there!

When this first initial drop sets a bottom and begins to retrace do not be fooled into thinking we are in for all time highs again. If history has proven anything it is this, the 50-70% retrace of the first drop is the time to get out not the time to turn back bullish! I’ve been telling members for months in our live trading room that this is the most dangerous market I think anyone living has ever seen. Every possible option to artificially prop up the equity market has been used. When this starts to crash hard, and it will, there is nothing left. The inevitable reset will come. Now is the time to learn to trade market crashes. Another fact of history is more millionaires are made through market crashes and economic depression than at any other time. People tend to forget (and are lied to) that MONEY DOES NOT DISAPPEAR IT IS SIMPLY TRANSFERRED! When the masses lose trillions that goes into the pockets of the few who know how to position themselves correctly. We are nearing historic times in my opinion. Those that know how to capitalize on it realize this is a once in a lifetime opportunity!

To summarize the most important part. We will likely see a 50-70% retrace of the initial drop. If I personally owned any equities long term this would be the point I would liquidate everything. If you know how to trade a market crash then that liquidated cash can be put to good use. If you don’t then I would highly recommend learning how to trade as we have historic times to come. Feel free to shoot me any questions or contact me on the chat.

-Sterling

P.S – I’ve been telling members of our live trading room for years that they need to have storeable food. I have personally used Efoods Direct and I have also heard good things about My Patriot Supply although I have not used them personally. Best case scenario you never use it and you all call me crazy:) Better prepared than screwed!